Credit repair apps and programs for loan accounting allow not only to obtain detailed statistics on all operations but also to get rid of the need to keep unnecessary information in your head.

Hardly anyone remembers how much he spent on a trip or a new TV 3 years ago, or how much you still owe the bank for a particular loan. But, if you save these data in the application – they will not be lost anywhere.

Mobile software for the accounting of credit transactions is much more convenient than desktop software, not to mention the storage of information in Excel or a paper notebook. Here you can not only quickly enter data but also find information about completed operations, make changes, export the database or restore it from a backup.

11 Credit repair apps, presented in this review, received positive ratings from users, depending on functionality and convenience.

You may also like: 17 Money-Saving Apps for Android & iOS

Credit Karma

Credit Karma is an application returns old payments to users. The new function of the application helps users to get those payments, which they have long forgotten – unannounced checks, old bank accounts, insurance payments, tax deductions. Since the launch of Credit Karma has already helped residents of California to return more than $ 75 million.

The American application Credit Karma was launched many years ago – it helps users to assess their credit rating and improve their financial situation. Now the company launches a new function – a service that returns various unclaimed payments.

In the United States, the total amount of unclaimed payments is more than $40 billion. This amount consists of such things as non-cash paychecks, old bank accounts, tax and insurance payments. After a company or financial institution loses touch with a person who needs to pay something, this money is transferred to the state authorities until they are required.

With the new feature, users can search for funds held by the state authorities in which they live or once lived. In addition, the application will notify them in advance of unclaimed cash in the future.

You may also like: 33 Free Mobile Games that Pay Real Money via PayPal

CreditRepair

This useful application will become your assistant in the event that you have burdened yourself with any credits. This application allows you to carry out the following manipulations with money:

- Tracking items removed.

- Track Creditor interventions.

- Track Credit Bureau Challenges.

- Track credit alerts.

You do not have to worry about the security of your online account and the money on your account. All data is encrypted, and the entrance to the personal cabinet is carried out only with the use of credentials that are known only to you.

Experian – Free Credit Report

With this application, you get access to all reports on your loans at any time convenient for you. There is no more credit card to carry around. Every 30 days, reports are automatically updated, so you will always have only the latest, accurate, and verified data. And convenient reminders will not let you forget about the most important thing – about your loans.

The application gives you the opportunity to view all your credit reports that your bank and creditors see. The program tracks the appearance of new credit accounts, as well as the appearance of any changes in your credit history.

Keep track of your costs and debts. An intelligent analytics system will analyze your credit situation and select the appropriate credit card for you.

Credit Sesame

Credit Sesame mobile platform: loans and credit rating in your smartphone. First of all, the consumer, having registered in the system (more precisely, tying his personal data on the account in the bank cooperating with Credit

Sesame to his account) receives an assessment of his financial condition and his accurate, truthful credit rating, as well as the status of his debts and possible options on receipt of certain loans.

Further, if the user needs to implement a particular goal, he selects it in the application, and the program provides him with all the necessary data on this issue.

The program calculates its capabilities in this issue. For him, suitable loans will be sought – in accordance with his current debts and financial condition.

That is, assessing the state of his personal finances, the application will automatically select the optimal, it is suitable for the option of a mortgage (for example), indicating the details up to the amount of the monthly payment.

Moreover, the program has the ability to even locate suitable apartments/houses, depending on the specified location (state, city, district). Moreover, directly from the application, the customer can “order” for himself the selected loan, that is, inform his bank about the need and the chosen option.

By the same principle, Credit Sesame can choose not only a mortgage loan but also other banking products. Among them – refinancing loans, financing repairs, obtaining consumer loans and loans to buy cars and so on.

Wallet: Budget Expense Tracker

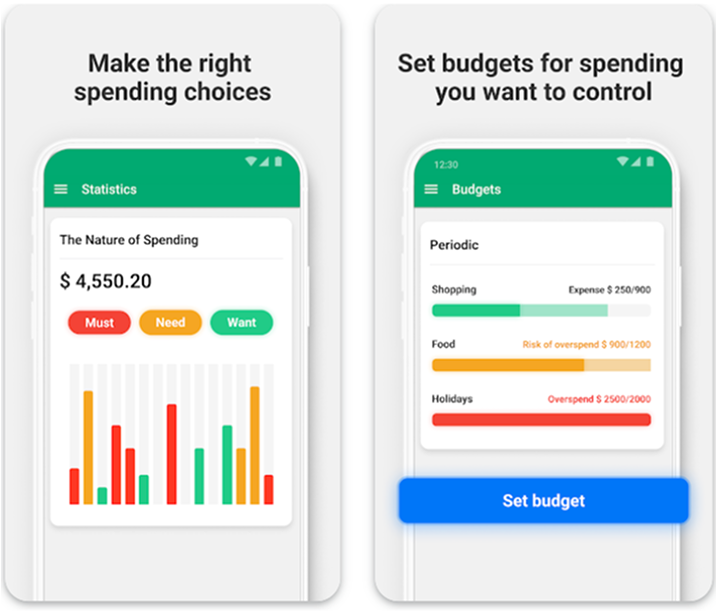

Wallet: Budget & Expense Tracker is a personal finance app designed to help you take control of your money with clarity and confidence. Whether you want to manage daily spending, plan long-term goals, or simply get a better understanding of where your money goes each month, Wallet puts essential budgeting and tracking tools right on your iPhone or iPad.

One of the core strengths of Wallet is how it brings multiple financial activities together in one place.

You can record your income and expenses manually or — in certain versions — sync transactions from bank accounts and cards to automatically capture your spending and categorize it. This gives you a clear, real-time view of your financial picture without manually entering every detail.

Budgeting with Wallet is flexible and practical. You can set up custom budgets for categories like groceries, rent, entertainment, or travel, and track how close you are to reaching your limits.

The app’s visual reports and charts help you see trends over time and make informed decisions about your spending habits. It also supports multiple currencies and accounts, making it useful for personal, business, or travel budgeting.

You may also like: 11 Best expense tracker apps for Android & iOS

Build & Fix Credit – Dovly AI

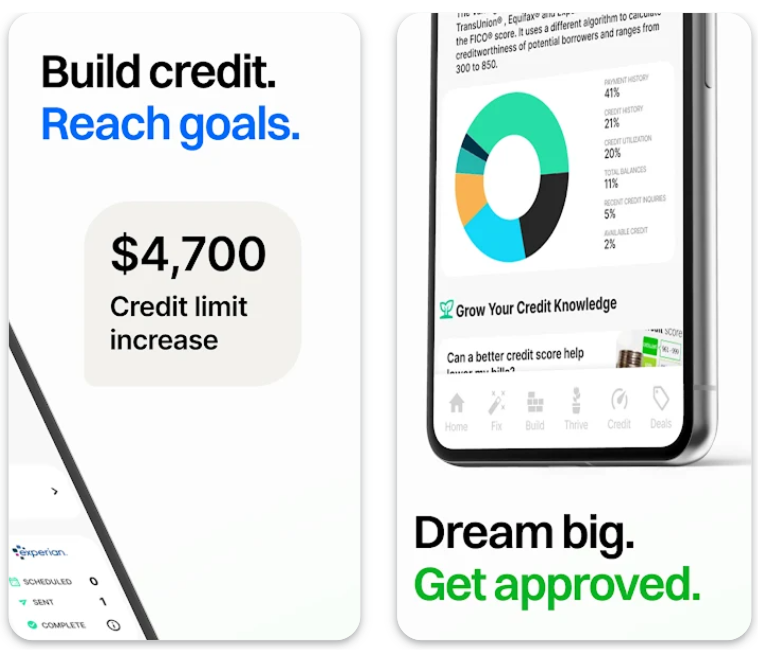

Dovly is a personal finance app designed to help you understand, build, and improve your credit score with the assistance of AI-powered tools.

This Android app combines credit monitoring, dispute management, personalized tips, and ongoing score tracking in one place, aiming to make credit health easier to manage without confusing financial jargon.

Once you install the app and sign up, Dovly connects to your TransUnion® credit report and score, giving you a clear view of your current credit standing. You can then get AI-driven insights into what might be dragging your score down and actionable suggestions to improve it over time.

The app also features tools to dispute inaccuracies, track progress, and receive alerts when changes occur on your credit report.

One of the standout aspects of Dovly is its credit score simulator, which lets you predict how certain financial moves — like paying down balances or opening new accounts — could affect your credit before you take action. This helps you make more informed decisions with less guesswork.

Credit Repair Yourself

The newest app for the repair of the credit. The reason why the novelty of it is its advantage is that it goes hand in hand with the latest law regulations concerning the repair of loans and credits. In order to use this app you first need to create your account and then put all the data about your current loan into the app.

Actually, there are many functions in the app. You can compile a claim in repairing your loan – there are templates for it in here, you can monitor your monthly expenses, and, what is interesting, store your digital signature here. The digital signature is a necessary attribute for signing up all the important documents.

Debit & Credit

According to the results of a solid study, the mobile application Debit & Credit is recognized as one of the best tools for iPhone budget management.

It is advanced and at the same time easy to use, allows you to record income and expenses, manage categories of spending that can be grouped, make transfers between accounts in different currencies, keep a joint account of finances, set a variety of budgets and prepare analytical reports.

You can specify multiple categories for a single transaction, attach photos and geometries to a transaction. The application supports 3D Touch and Siri, has an informative widget, and the ability to customize the appearance.

There is also a reconciliation mode with the Bank statement on the iPad. The level of security of the application corresponds to high indicators.

The mobile app receives regular updates, has a version for Mac, iPad, and Apple Watch shows the correct and stable performance. In addition, Debit & Credit, unlike most other applications, is adapted for people with disabilities. Up to two accounts can be added to the free version.

The program has a wide range of features, including transaction files (with synchronization between devices), transaction tags, printing and exporting reports to PDF files, exporting/importing transactions, and much more.

Credit.com

The peculiarity of this application is that it makes an expert decision on your loans, depending on the individual circumstances of the user. Here you will also find recommendations for saving money. For you, free online ranking of your credit history is available, as well as a detailed explanation of the valuation changes.

The program will kindly prepare for you the forecast for short-term or long-term use of the loan. See the recommendations for repair your credit. Be always aware of the status of your credit bills with the Credit.com application.

Kikoff

Kikoff – Build Credit Quickly is a personal finance app designed to help people start or improve their credit score in a structured and accessible way.

Unlike traditional credit cards or loans, this app focuses on helping users build positive credit history without hard credit checks, interest charges, or hidden fees — a model that attracts beginners and those rebuilding their financial standing.

At its core, Kikoff offers a credit builder account with monthly plans starting at about $5 per month. When you sign up, your on-time payments are reported to all three major credit bureaus (Equifax, Experian, and TransUnion), which can strengthen key credit score factors such as payment history, credit utilization, and account age.

This reporting is essential because consistent, reliable activity on your credit report is a major factor in improving your credit score over time.

The app also includes credit education tools, a dispute system for inaccuracies on your credit report, and — with higher-tier plans — features like rent and bill reporting, credit monitoring, and even debt negotiation support. These extras provide users with broader financial tools beyond basic credit building.

You may also like: 11 Best apps like Ibotta to save money (Android & iOS)

Lexington Law

It’s no secret that most people are financially uneducated. The loan might be an essential part of our lives today however, taking loans without any control is packed for heavy consequences. Never lose track of the repayment of your loan, plan your budget, and raise your credit score.

Following all your expenses and loan repayments is also important in the sense that you can track where are the weakest places in your budget and where is that hole where all the money sinks into. Lexington Law is a great tool that will help you to take control of the repayment of all your loans along with many other useful functions.

Just put all the data about your expenses into the app and then it will start to prepare the statistics for you. Don’t forget the details – put all the information about the loans that you have, the monthly payment and the interest rate. Why is this needed? Lexington Law app will analyze if the repayment of your loan is 100% legal.

You will be surprised, but according to the statistics, over 10 million inaccurate, unfair, or unsubstantiated negative items from credit reports in 2017 were removed from the loan obligations of the users of this app. On average our clients see 10.2 negative items or 24% of their presenting negatives, removed within the first 4 months of service.

In other words, Lexington Law will get your back financially and juridically. Even if you already have a loan, you can always but the data about it into this app and it will analyze how you possibly can improve the situation and save your money.